07 Mar 2019

Engineering & Construction M&A Outlook

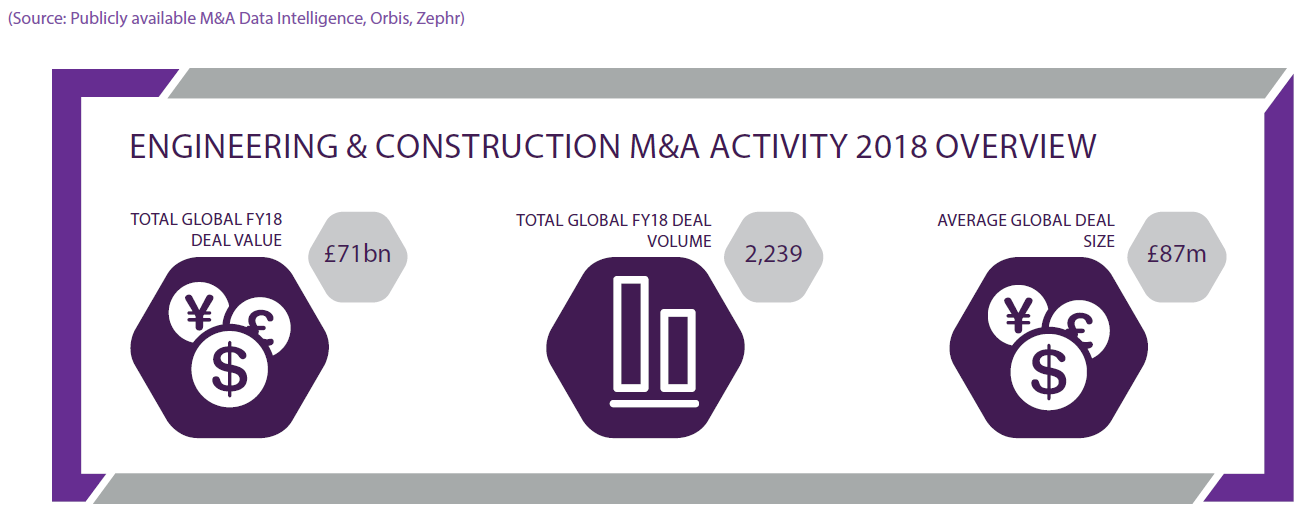

Deal value in 2018 was £71 billion, a decline of 21% over 2017. However, the deal value in Q4 increased by 12% on the previous quarter buoyed by two material transactions announced in Q4, including Hitachi’s acquisition of ABB’s Power System Division. At a regional level, 55% of deal value was attributable to Asia and Oceania acquirers, and 67% of deal value by strategic investors.

This pattern carries over to target regions, with Asia and Oceania domiciled companies accounting for 42% of the deal value in 2018. The UK and Eurozone’s decline in attractiveness as a target (12.5% by deal value) can be put down to the region’s changing geopolitical landscape, Brexit being a key factor. Nevertheless, there were almost 400 disclosed deals in 2018 with a total value of £6.6bn, of which £2.2bn had a UK/Eurozone company as the target.

The UK has a positive outlook. The construction industry accounted for 6% of GDP in 2017, this is bolstered by a greatly increasing population in urban areas of the UK, with forecasts from industry professionals stating that over 10,500 new homes will need to be constructed a month for the next 20 years to meet the demand. We expect the construction & engineering market to prosper throughout 2019 driven by an ageing infrastructure, growing population, and increasing infrastructure requirements for energy sources.

Recent Transactions

Camlee has a breadth of cross-border experience in advising UK based companies in the Engineering & Construction sector. In its most recent transaction, The Camlee Group advised BCM Scaffolding Services, a leading access provider within the Greater London area serving a blue-chip client base in construction, on its sale to Safe Rise Scaffolding Group. Safe Rise Scaffolding is a newly formed group of scaffolding companies throughout the UK and the acquisition will give rise to further expansion.

This built on The Camlee Group advising west midlands based UK Sundecks, a leading decking contractor for lodges and park homes, on its sale to Suffolk-based Omar Group, a portfolio company of Rutland Partners. Established in 1965, Omar is one of the UK’s leading manufacturers of residential park homes and luxury lodges. UK Sundecks was identified by Omar Group as an excellent opportunity to expand the services it can provide its park customers.

These recent transactions demonstrate The Camlee Group’s continued success in the sector, further illustrated by the sale of Xtralite, one of the largest manufacturers of customised roof lights and structural glazing solutions in the UK, to German domiciled Jet Group, a leading rooflight and ventilation manufacturer and distributor.