Chemicals 2019 M&A Outlook

07 Mar 2019

Chemicals 2019 M&A Outlook

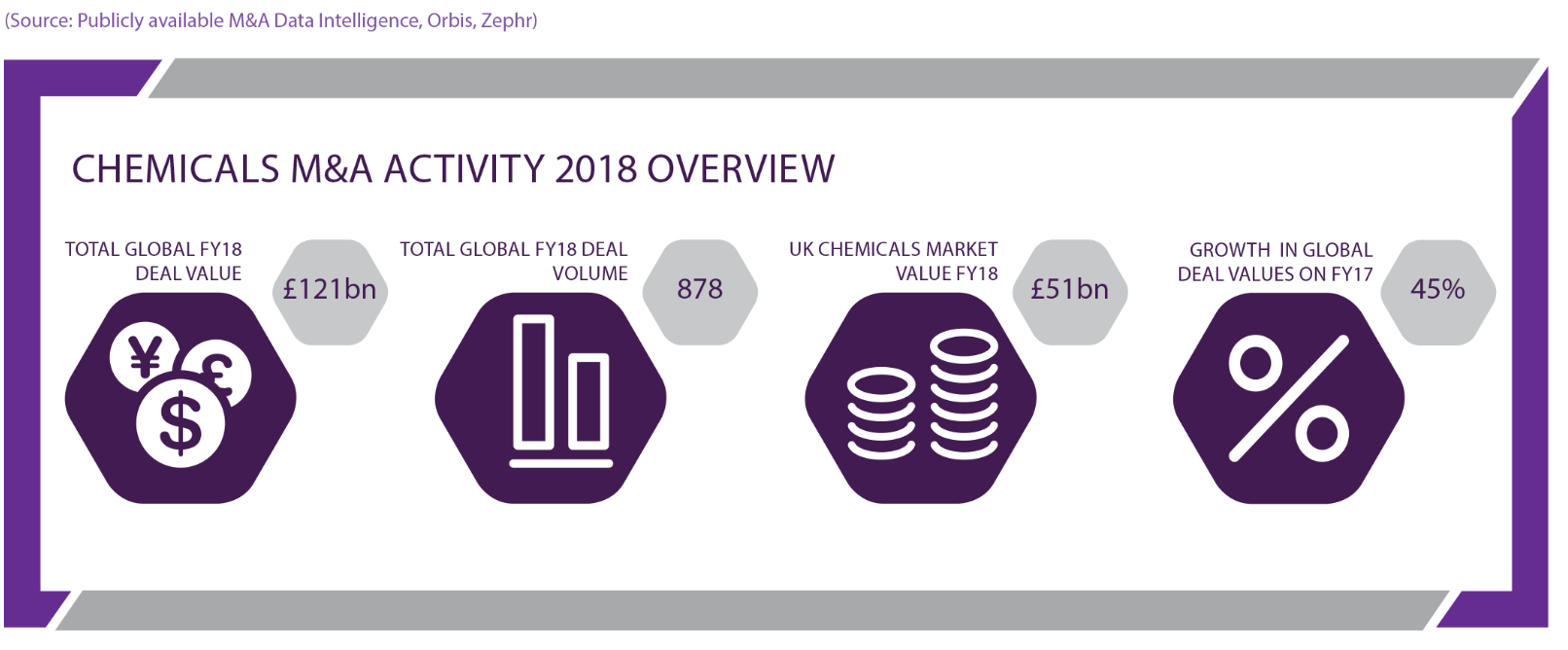

Global deal volume in the chemicals market decreased by 12% in 2018, though total deal values increased by 45%, indicating that even though fewer transactions are taking place acquirers are willing to write bigger cheques for the right businesses. Deal volume in the UK chemicals market remained steady throughout 2018. This was fortified by international investors’ interest in owner managed UK specialist chemical manufacturers, driven by their presence in niche markets, possession of IP and access to specialist knowledge.

Current market conditions are buoyant allowing sellers to obtain higher than average valuations. This is underpinned by a number of factors such as Brexit uncertainty and its impact on the value of sterling, making overseas investment more attractive. There has been growing concern around the stability of future revenue streams, which has played a pivotal role in pushing valuations upward as investors look to mitigate the risk. In particular, we have witnessed an increasing focus on the circular economy, whether through recycling, regulation or substitution. In addition to this the ongoing trade war with the US is likely to incentivise Chinese acquirers to pursue European targets in 2019.

The UK chemicals market has a forecast value of over £52bn for 2019 and is prime for consolidation. We expect that throughout the year, M&A activity will likely be focused on lower mid-market transactions and current deal values indicate this is a sellers’ market as acquirers pursue further advancements in technologies and products.

Recent Transactions

Camlee has a breadth of cross-border experience in advising UK based companies in the chemicals sector. In its most recent chemicals transaction, Camlee advised DVM Pigments, a UK manufacturer of aqueous pigment dispersions on its sale to Chat Investments, the UK arm of TRCC and other unnamed partners. Headquartered in Georgia, USA, TRCC is an international business involved in the manufacture and distribution of a wide range of innovative chemicals, products and technologies. The strategic acquisition of DVM allowed it to significantly enhance the capabilities and market reach of TRCC and its partners.

This built on Camlee’s success in advising Norfolk based IFS Chemicals, a leading international manufacturer of bespoke chemicals for foamed and solid elastomeric polyurethanes on its sale to NYSE listed Huntsman Corporation based in Texas, USA. IFS was established over 35 years ago and its bespoke MDI systems are commonly used in a diverse range of end markets, including the insulation, appliances and automotive sectors. The purchase of IFS provided Huntsman with enhanced access to the growing downstream MDI formulations market in the UK.

These recent transactions exemplify a long lineage of success in the sector, further illustrated by the sale of ALH Systems to Sweden based Indutrade. ALH Systems specialises in the supply of formulated polyurethane and epoxy encapsulants, sealants, adhesives and potting compounds primarily to customers in the gas industry, but also serving additional markets.